The Department of Finance (DOF) reiterated that the Tax Reform for Acceleration and Inclusion (TRAIN) not only benefited employees receiving an annual pay of P250,000 but, also those with a yearly taxable income of up to P2,000,000.

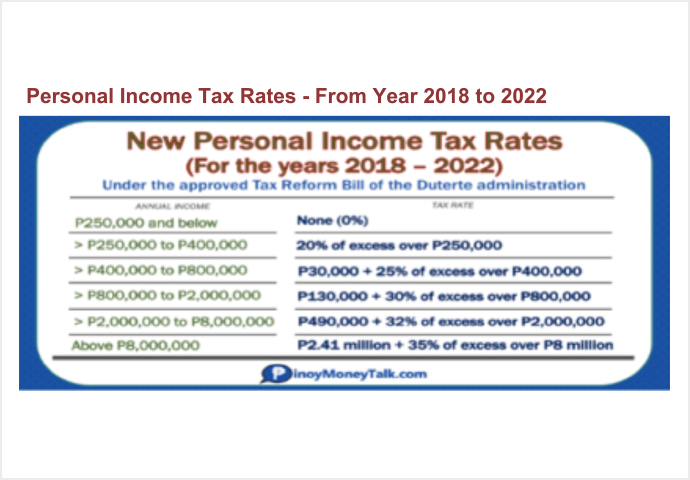

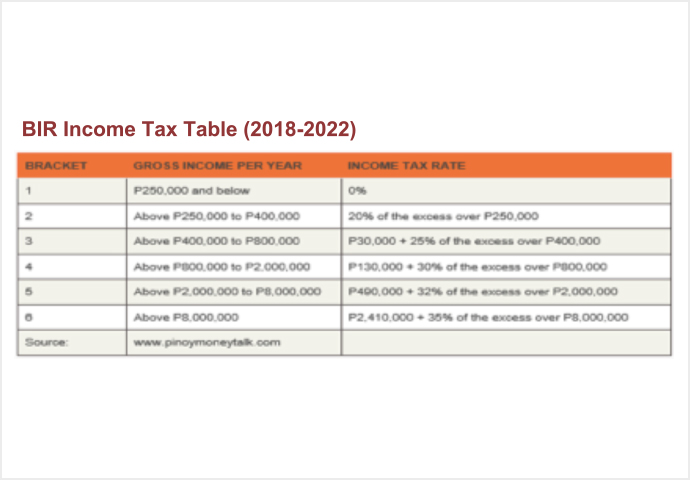

In the past, individuals earning above P250,000 a year, but less than two million pesos, used to pay around 30-32% in taxes on their taxable income. However, in five years of TRAIN's implementation, employed individuals would only pay 20-30% on their personal income tax, said Finance Secretary Carlos G. Dominguez III.

The TRAIN law was signed by President Duterte in December, 2017 and was implemented beginning on January 1st, 2018. Taxes on oil, cigarettes, sugary drinks, and vehicles, among other goods, were also affected in order to compensate for the restructured personal income tax.

The 13th month pay and other bonuses not exceeding a total of P90,000 are also tax-free under the new TRAIN law, Dominguez added.

Under the new law, adjustments were made so that middle to upper-middle income taxpayers would be able to enjoy higher take-home pays by paying lower tax rates.